In the arena of finance, locating the proper stock to invest in can be much like finding a needle in a haystack. With such lots of options available, it could be overwhelming to determine which stocks are nicely well worth your time and money. If you’re an investor looking for a promising choice, Rheinmetall inventory have to be to your radar. This blog post will manual you via the nuances of Rheinmetall inventory, why it’s an appealing investment, and what you should recollect in advance than developing a waft.

What is Rheinmetall?

Rheinmetall is a main engineering and production organisation based totally in Germany. Known for its innovation and robust portfolio, Rheinmetall operates in primary sectors—Automotive and Defense. The enterprise employer has a strong reputation for generating first rate merchandise beginning from automobile components to superior navy device. This diverse portfolio makes Rheinmetall stock an exciting desire for investors who’re seeking out balance and growth.

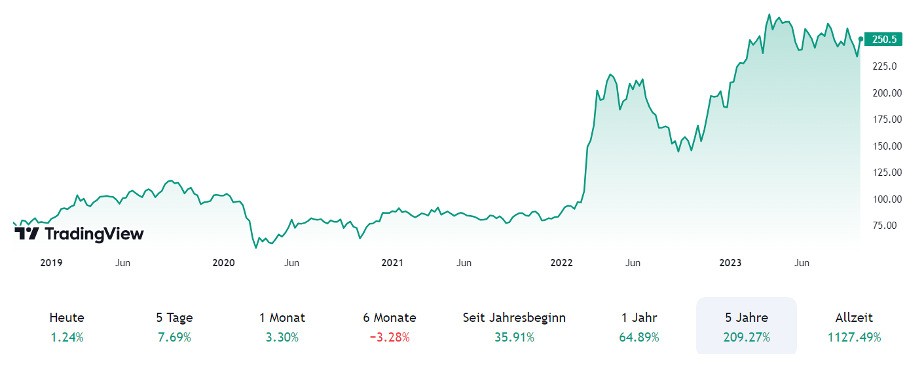

Historical Performance

Rheinmetall inventory has had its americaand downs, but a have a take a look at its historical ordinary performance can provide valuable insights. Over the past decade, the stock has proven a regular boom in fee, reflecting the business enterprise’s boom and a success ventures. The corporation’s capability to adapt to market situations and innovate has performed a large position in its overall performance. By information its historic tendencies, investors can advantage a higher attitude on what to anticipate inside the future.

Financial Health

Before investing in any inventory, it’s crucial to evaluate the enterprise’s economic health. Rheinmetall’s economic statements monitor a strong balance sheet with wholesome income boom and profitability. The business enterprise’s debt ranges are achievable, and its cash float is powerful, it really is a nice indicator for capacity buyers. These financial metrics advocate that Rheinmetall is nicely-positioned to climate financial downturns and capitalize on boom opportunities.

Growth Prospects

Rheinmetall’s growth potentialities are promising, specifically in its Defense location. With growing worldwide protection budgets and growing geopolitical tensions, the demand for superior military device is predicted to increase. Rheinmetall is nicely-located to gain from this trend, way to its cutting-edge-day technology and know-how. Additionally, the employer’s Automotive area is likewise poised for boom, driven by way of the shift inside the course of electrical powered vehicles and sustainable transportation answers.

Diversification

One of the critical issue blessings of making an funding in Rheinmetall inventory is the organization’s assorted portfolio. Unlike corporations which can be entirely dependent on a single organisation, Rheinmetall’s presence in each the Automotive and Defense sectors gives a buffer against market volatility. This diversification no longer most effective reduces threat however additionally gives multiple avenues for increase and profitability.

Competitive Advantage

Rheinmetall’s aggressive benefit lies in its innovation and facts. The employer invests closely in studies and improvement, making sure that it stays in advance of the curve. Its superior era and terrific merchandise have earned it a strong popularity within the marketplace. This competitive facet is a massive element that might power the inventory’s general performance in the end.

Risks and Challenges

Like any investment, Rheinmetall stock comes with its own set of risks and demanding situations. The cyclical nature of the automobile organization and capability finances cuts in safety spending can impact the business company’s revenue. Additionally, geopolitical risks and regulatory adjustments can pose challenges. It’s important for customers to be aware about the ones risks and component them into their funding picks.

Market Sentiment

Market sentiment performs a important role in inventory performance. Positive news and inclinations associated with Rheinmetall can boost investor self assurance and pressure the inventory price up. Conversely, negative information can result in a decline in inventory price. Keeping an eye fixed constant on market sentiment and staying informed about the brand new inclinations can assist traders make informed alternatives.

Expert Opinions

Financial professionals and analysts regularly provide precious insights and recommendations on shares. Many analysts have a best outlook on Rheinmetall inventory, bringing up its sturdy fundamentals and increase potentialities. Paying hobby to professional critiques and tips can offer more perspectives and assist traders make nicely-knowledgeable alternatives.

How to Invest in Rheinmetall Stock

Investing in Rheinmetall inventory is simple. You can purchase the inventory through a brokerage account or an internet buying and selling platform. It’s vital to do your research and choose a reputable platform that gives competitive charges and reliable offerings. Additionally, keep in mind consulting with a financial manual to make sure that your investment aligns collectively together with your monetary goals and risk tolerance.

Monitoring Your Investment

Once you’ve invested in Rheinmetall stock, it’s crucial to expose your funding regularly. Keep song of the corporation’s overall performance, marketplace dispositions, and any relevant news. Regular monitoring lets in you to make nicely timed choices, whether or not or no longer it’s keeping onto the stock, shopping for greater, or promoting. Staying knowledgeable and proactive can help you maximize your returns and decrease dangers.

Long-Term vs. Short-Term Investment

Deciding between an prolonged-time period and brief-time period investment approach relies upon for your economic dreams and risk tolerance. Rheinmetall inventory has the capacity for long-time period increase, making it an attractive desire for long-time period investors. However, brief-time period shoppers can also benefit from marketplace fluctuations and capitalize on fee actions. Assess your funding horizon and choose a method that aligns collectively along with your goals.

Conclusion

Rheinmetall inventory offers a compelling investment opportunity for those trying to diversify their portfolio and capitalize on increase possibilities. With a robust economic foundation, revolutionary products, and a diverse portfolio, Rheinmetall is well-positioned for fulfillment. However, it’s crucial to conduct thorough studies, recollect the dangers, and live informed to make the maximum of your funding. If you’re prepared to discover this opportunity similarly, recollect signing up for our funding e-newsletter for more insights and professional pointers.